לעברית הקישו כאן

Your personal private data is at risk !

Only you can help yourself

Tax preparers / accountants / CPA's need to comply with a new complex rule.

Let’s TalkYour online safety is our top concern

FTC Rules are complex

We understand FTC Rules

Hackers can devastate your well being!

The Federal Trade Commission (FTC) will soon be enforcing a new rule called The Safeguards Rule. The Rule affects anyone (individual or firms) who handles consumer financial information (think your CPA's, accountants, Tax Preparers, Car Dealerships, etc.) These individuals or firms hold what is knows as Private Personal Identifiable Information. Meaning data that should not be known to others like Social Security Numbers and Income as opposed to information which can easily be gathered like personal address and phone numbers. Hackers have long been targeting financial firms due to the vast amount of information they can gather about individuals (and companies). Once a hacking groups manages to compromise and steal this data from the financial firm, they can either hold them ransom or start compromising the people who’s data was stolen.

This is where you come into the picture!

The FTC, like many other government agencies, is doing a poor job at communicating these enforceable requirements to the target audience. Anyone who submits a tax return for a consumer needs to have a PTIN number (Paid Preparer Tax Identification Number).

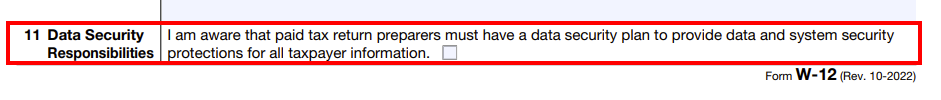

Every year they need to fill out a form called W-12.

The smallest portion of the form reads: I am aware that paid tax return preparers must have a data security plan to provide data and system security protections for all taxpayer information.

While it is plainly visible, most firms and individuals we have spoken with are not aware of the implications of putting a checkmark in this box.

How can I help protect my information ?

We need your help to inform as many CPA's, Accountants, Tax Preparers and Car Dealerships about this.

- I want to share this information with my tax preparer / accountant / CPA [SHARE VIA EMAIL]

- I will let my tax preparer / accountant / CPA know they need to read the information in this link: https://www.bluelightit.com/ftc-safeguards-rule/

- Here’s my tax preparer / accountant / CPA information. Please contact them directly and let them know I referred you:

You can also contact your tax preparer / accountant / CPA and ask them if they are familiar with the FTC Safeguards rule and if they comply with it.

Help yourself stay secure online by helping your tax preparer stay safe.

Take action today!

Testimonials

Their pricing makes it simple to budget for IT expenses. We appreciate not seeing unexpected fees on our monthly bills.

—Abe F., IT manager, agricultural company

We rely on Blue Light and have used them for many years. They are very professional and easy to work with. Highly recommend.

—David G., COO, real estate company

Our previous IT company just didn’t give us the support we needed. The people at Blue Light respond fast when we ask for help.

—Tim A., CEO, accounting firm

Latest from Our Blog

Blue Light IT Warns of Post-Hurricane Milton Cyber Threats Targeting Victims and Donors

read more

What’s the Real Cost of Not Partnering with a top IT Services Provider?

Technology is part of everything you do; You don’t want to be left in the dark when your operations, security and livelihood are at stake. Relying on an MSP that doesn’t offer stability, predictability and cyber resilience could be a risky move.

Entrust your business to a team of reliable and responsive experts: You won’t regret it.

- Reach out to our experts.

- Get a cybersecurity risk assessment.

- Partner with Blue Light IT and be protected.

Contact Us

Enter your details below and we will contact you within 1 business day.

"*" indicates required fields